Since many individuals prefer to avoid cleaning, the industry demand for cleaning services is consistently growing. Therefore, starting a cleaning business can be a lucrative endeavor. Still, you can quickly become overwhelmed with each of the different components of starting your cleaning business. One of the critical components you must understand when launching your cleaning business is which business licenses will be required and how you can obtain them. Though it may initially seem challenging to navigate, getting a business license for your cleaning business can be a simple project if you approach it correctly.

First, when beginning your journey to acquiring the correct business licenses for your cleaning business, determine whether your cleaning business will be residential or commercial. Licenses are the same for each, whether you plan to offer a singular service or both options. Next, we will review the requirements for obtaining business licenses when beginning a cleaning business.

Overview of Beginning a Residential Cleaning Business

As demand continues to grow, residential cleaning businesses are becoming more rewarding in return on investment. Where society previously centered on a singular individual as the homemaker, roles have been redefined. Seeking outside cleaning services is not only acceptable behavior, but it is now becoming more and more encouraged. As individuals find themselves juggling forty-plus hours of work, children, and frequently continuing education commitments, the services of a cleaning business are much desired and needed.

With this in mind, beginning a cleaning business opens the door to endless possibilities and a vast open pool of potential clients. However, you will still want to ensure it is properly licensed before you can start turning a profit for your cleaning business.

Methods for Choosing Your Business Entity

When beginning your cleaning business, you will first need to choose the business entity to obtain your business license. Choosing a business entity and registering your business allows you to get your business license and operate within the state.

What this means in simple terms is that you have to decide how you want to be classified in terms of taxes and legal protection. Different types of business entities afford other types of security and determine how your business expenses and revenue will be taxed.

When considering which entity is ideal, before even reviewing the different types, take a moment to review your cleaning business’s services and daily routine. Survey whether you will have employees, and if so, what will they be doing daily? Will it require entry into private homes and commercial buildings? If so, you want to be sure to choose a business entity that would allow the business to be responsible for liability instead of you.

Understanding Business Liability

You may be wondering, what does it mean for the business to be held liable? Whether a company or individual is responsible depends on how the business was formed and which entity was selected. When selecting an entity, you may choose sole proprietor, partnership, corporation, or a limited liability corporation (LLC).

A sole proprietorship and partnership will force you to use your personal assets to pay off any debt owed by the business; this goes for partners as well. It is also helpful to know that a sole proprietorship is also known as a DBA (‘Doing Business As’) registration. This entails operating under a business name without separating personal and business assets, quite a risky endeavor.

In contrast, selecting a corporation or limited liability corporation means the business has a shield, in a sense, allowing those with an ownership interest in the company to protect themselves from personal liability. This, in turn, means the individual will not be held personally liable for paying the business debt. This can be an especially critical element, particularly for new businesses testing the water.

This may also ring particularly true when considering the possibility of complaints leading to lawsuits concerning civil actions due to increased exposure to potential risks. Therefore, it may be helpful to consult with an attorney before forming your business entity. Of course, various aspects correspond to each. Still, a selection will be required to properly obtain the needed business licenses for your cleaning business.

Making the Ultimate Decision

It may seem daunting to decide which entity is best for you, but the selection process can be simplified. For example, if you plan to have fewer than a handful or so of customers and are just testing the waters with your cleaning business, a sole proprietorship would be a reasonable and sufficient option. Alternatively, if you plan on your cleaning business expanding and potentially hiring employees, selecting an LLC or corporation will likely better suit your cleaning business’s needs. In addition, this choice will probably best protect your personal assets from being used as a form of payment for debts incurred by the company.

After making your selection, visit your state agency’s website to register your business under your selected name and entity choice. When searching for your state agency website, be wary that alternative sites are purporting to assist in registering companies. The process can be done individually or with the assistance of an attorney or third party. Still, the best place for information is the Small Business Association’s official website.

Quickly Obtaining Your Vendor’s License

Once you have finalized your selection for your business entity to obtain your business license, you will need to get your vendor’s license. However, a vendor’s license may not be obtained without first having an approved business license. This is why it is imperative that you first register and receive your business license. This can be done through your state agency before attempting to obtain a vendor’s license for your cleaning business.

Once you have successfully registered your business and obtained your business license, you are able to begin the process of getting a vendor’s license. Because it is required that business owners pay sales taxes on any non-wholesale revenue, a vendor’s license is required when beginning your cleaning business. Although you may believe you can evade state tax by simply not obtaining a vendor’s license, you must obtain a license to prevent any legal penalties and fees.

There are two different kinds of vendor licenses available for businesses and individuals in most areas. First, the county license is sometimes referred to as a ‘fixed location license.’ Then, on the other hand, there is the Transient vendor’s license. Each of the names nearly gives its function away.

Comparing County Vendor’s Licenses and Transient Vendor’s Licenses

The County, or ‘fixed location license,’ is the option you would want to choose if you plan to sell or offer a particular service from a single non-moving location. Alternatively, there is the Transient vendor’s license. This license is, in essence, the opposite of the County, or ‘fixed location license.’ The transient vendor’s license is one offered to individuals wishing to sell or provide a specific service moving from one location to another using a mobile truck, store, or van. In the event that you have no fixed place for your business, then a Transient vendor’s license would be the best option suited for your business. A cleaning business is one that will have a fixed location for business, so a Transient vendor’s license would not be the best option for a cleaning business when beginning.

When obtaining a vendor’s license, it is crucial to understand the responsibility that comes with it. First, individuals can get an application through their county auditory or a similar department of tax office within their County. Then, following the application submission and approval for the vendor’s license, a business will be responsible for collecting the appropriate amount of sales tax from customers.

Thinking of collecting tax may be stressful, but there are numerous programs to assist, as well as various options for minimal accounting services to help small businesses. Additionally, you will be responsible for filing tax returns that reflect the amounts of the tax collected. In addition, maintaining complete records of each transaction and the amount of sales tax collected is a requirement of maintaining the vendor’s license.

However, it is essential to verify with your specific locality regarding requirements. Some locations have less stringent requirements, which may not necessitate a license for certain size businesses. Either way, verifying through the state’s official website is the best determinant for which licenses are required. The vendor’s license is one that many states require and, if not obtained, can result in hefty fines and penalties against the individual or business.

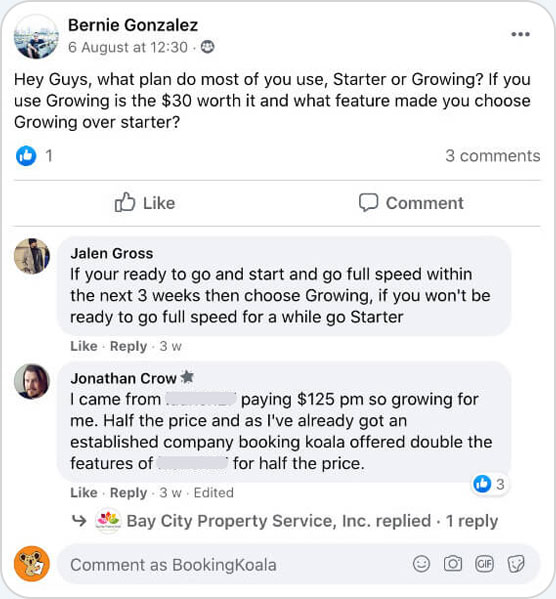

Join Our Facebook Community

Join Facebook GroupReview of Relevant Licenses When Beginning a Cleaning Business

Overall, it has become clear that the need for cleaning businesses and cleaning services is continually expanding. As the market and demand increase, it is helpful to know the requirements when deciding to begin your own cleaning business. In addition, knowing which business licenses are required to start a new cleaning business is essential in facilitating a recent business’s success. This is especially true against competitors who may be seasoned veterans of the cleaning business industry.

First, when deciding to begin your own cleaning business, you must establish a business entity. Choosing a business entity has long-lasting effects, so the choice mustn’t be one that is made hastily. Instead, individuals should select the business entity for their business license that best suits the projected interests of the cleaning business in the future.

For small businesses, it may make sense to being as a sole proprietorship. Still, individuals must keep in mind the significant risk when establishing small. Individuals may be placing their own personal assets at risk by choosing to form as a sole proprietorship or partnership.

Additionally, individuals are able to activate somewhat of a shield if they choose to form their business as a corporation or limited liability corporation (LLC). Companies can enjoy having their individual personal assets kept separate from those of the business. In this instance, if the industry were to incur any debt, the individual would not have their personal assets taken to pay the obligations of the business. The assets would be considered separate.

Furthermore, a business will need to obtain a vendor’s license after the business license is received after selecting the business entity and registering with the state agency. A vendor’s license is essential because it relates to the collection of state taxes, something that all states, of course, have an ongoing interest in. For businesses that attempt to avoid paying taxes, several penalties and fines can be assessed against them. This can make obtaining the license more beneficial and paying the sales taxes as required.

Vendor’s licenses have two different types, County or ‘fixed location licenses,’ and Transient vendor’s licenses. Each of these serves a different purpose, with the County vendor’s license being the option for businesses that are selling from a fixed location. In contrast, the Transient vendor license is specifically for those who want to sell goods in various locations and markets throughout the state.

The County or ‘fixed location vendor’s license’ is the best option when looking at a cleaning business. This is because, as a cleaning business, you will have a fixed location; even if you are sending employees out to others’ homes, you will be home-based from one place.

In summary, the two main licenses required for beginning a cleaning business are the business license and the vendor’s license. The business license is required before the vendor’s license can be provided, so determining a business entity is the critical first step in establishing a new cleaning business. However, if the steps are followed, it can be a quick and straightforward process to develop your own cleaning business. Before you know it, you will be able to obtain each of the necessary licenses that will allow you to begin earning immediately.

Individuals should always be sure to check with state and local regulations before making long-term financial decisions. There may be particular areas where the requirements are more stringent. Alternatively, there may be areas where the conditions are laxer. You could save yourself some work by investigating the requirements before beginning your process. Then, taking your time and obtaining the necessary business licenses for a new cleaning business will be a breeze.

To help you get started in the cleaning industry, check out these helpful blog posts:

- How to start a cleaning business

- How profitable is a cleaning business

- Cleaning business marketing ideas

- Best cleaning business names

- Cleaning business insurance

- Cleaning business license

- Finding employees for cleaning business

- How much should I pay my cleaning employees

- How much should i charge for cleaning a house

- Cleaning business software